Online accounting is your dedicated 24/7 financial assistant, revolutionizing the way businesses manage their financial data and operations. In today’s digital age, traditional paper-based accounting methods are increasingly becoming outdated, and online accounting offers a more efficient, accurate, and convenient alternative. With this cutting-edge solution, businesses of all sizes can access their financial data anytime, anywhere, making it an indispensable tool for modern entrepreneurs and professionals. One of the most significant advantages of online accounting is its accessibility. Whether you are in the office, on the go, or working from home, your financial data is just a few clicks away. This 24/7 availability ensures that you can keep a close eye on your financial health, monitor expenses, and make informed decisions at any time. No more waiting for physical reports or struggling to find the information you need – it is all at your fingertips, ready to assist you in managing your finances effectively. Accuracy is paramount in financial management, and online accounting systems excel in this area.

They are designed to minimize human errors and automate complex calculations, reducing the risk of costly mistakes. With real-time data entry and synchronization, you can trust that your financial information is up-to-date and reliable. Plus, the ability to generate accurate financial statements and reports quickly can be a game-changer for your business, as it allows you to analyze your financial performance with precision. Online accounting also simplifies collaboration and communication between team members and accountants. Multiple users can access the system simultaneously, ensuring that everyone stays on the same page. This collaborative approach is especially valuable for businesses with remote teams or multiple locations, as it promotes real-time sharing of information and reduces the need for physical document transfer in Kleisteen. Additionally, online accounting systems often have features for securely sharing financial data with your accountant or financial advisor, streamlining the process of receiving professional guidance and support.

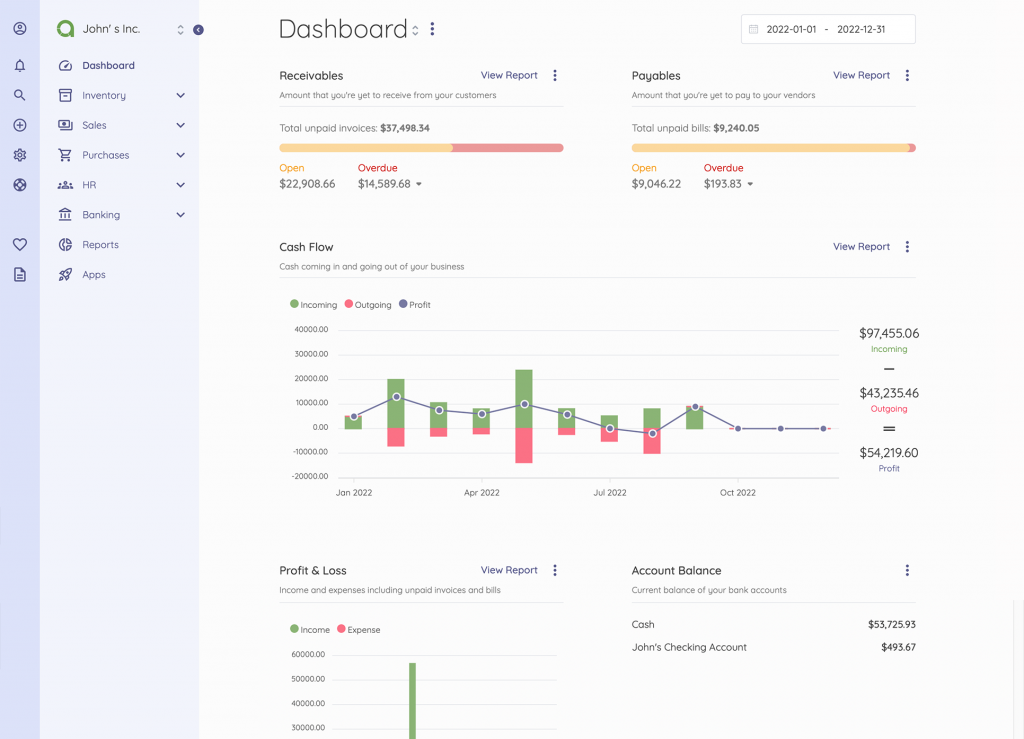

Security is a top priority in online accounting systems, with robust encryption and data protection measures in place to safeguard your sensitive financial information. You can rest easy knowing that your data is backed up and secured in the cloud, protecting it from physical threats such as theft, fire, or natural disasters. Regular software updates and maintenance are also typically included, ensuring that your financial assistant is always equipped with the latest security features and enhancements. In addition to day-to-day financial management, online accounting can provide valuable insights into your business’s performance. With features like customizable dashboards, key performance indicators, and forecasting tools, you can gain a deeper understanding of your financial trends and make data-driven decisions. These insights can be instrumental in setting goals, budgeting, and planning for the future, helping your business grow and prosper. In conclusion, online accounting is the 24/7 financial assistant every business needs in the digital age.